Shares rise on optimism about Trump-Xi talks

RECAP: Asian shares rallied on Friday as confirmation that the leaders of the United States and China would meet raised hopes for progress on trade talks ahead of a looming tariff deadline.

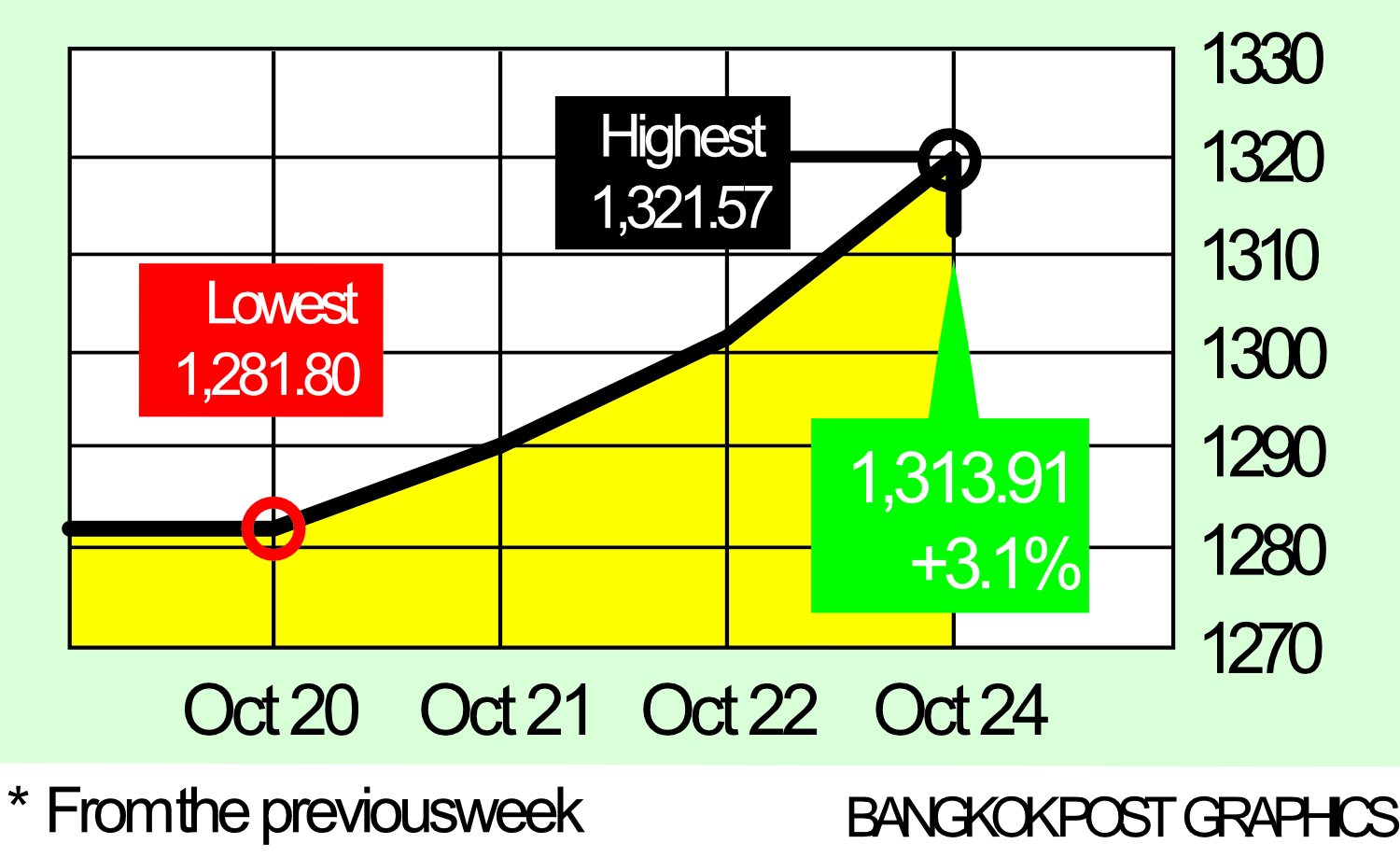

The SET index moved in a range of 1,281.80 and 1,321.57 points this week, before closing on Friday at 1,313.91, up 3.1% from the previous week, with daily turnover averaging 40.83 billion baht.

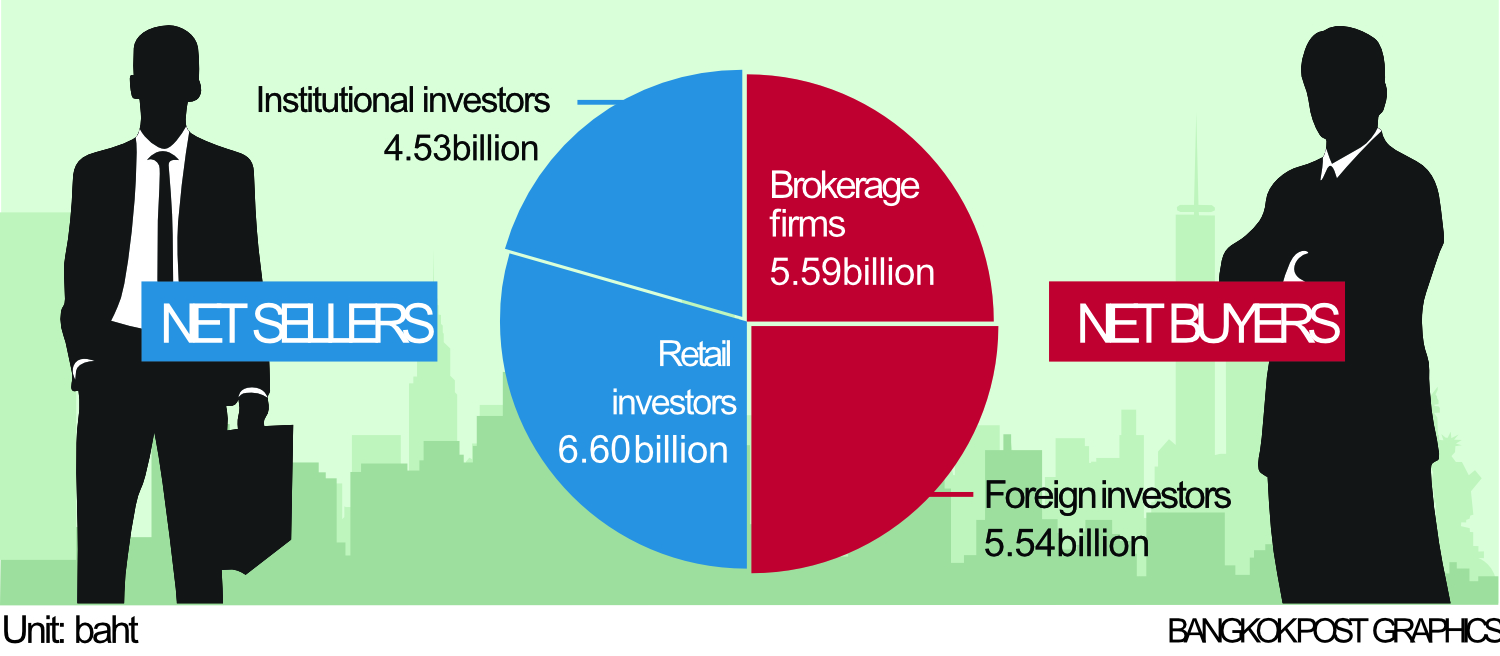

Brokerage firms were net buyers of 5.59 billion baht, followed by foreign investors at 5.54 billion. Retail investors were net sellers of 6.6 billion baht, followed by institutional investors at 4.53 billion.

NEWSMAKERS: The White House confirmed that President Donald Trump and Chinese President Xi Jinping will meet when they attend the Asia-Pacific Economic Cooperation (Apec) summit in South Korea next week, easing concerns over trade friction.

The US announced new sanctions targeting Russia’s two largest oil companies, Rosneft and Lukoil, a day after Trump shelved a planned meeting with President Vladimir Putin in an effort to pressure Moscow to negotiate a peace deal in Ukraine.

Gold prices were on track for their first weekly decline in 10 weeks, weighed down by a stronger dollar and easing concerns about trade. Spot gold was down 3.8% from a week ago, at around $4,060 an ounce.

China’s economy grew 4.8% year-on-year in the third quarter, keeping the country largely on track to achieve its full-year target. The reading was the weakest in a year but in line with expectations despite the ongoing real estate slump.

China’s industrial production climbed 6.5% in September, up from 5.2% growth in the previous month. Retail sales grew by 3%, in line with expectations.

Japan’s core inflation rose 2.9% year-on-year in September, up from 2.7% in August, keeping the Bank of Japan on track to hike rates and adding challenges facing new Prime Minister Sanae Takaichi.

Taiwan’s export orders in September jumped by 30.5% year-on-year to an all-time high of $70.2 billion, driven by continued expansion of AI infrastructure demand.

Bank Indonesia unexpectedly kept its policy rate unchanged at 4.75% on Wednesday, saying it would now wait to assess the impact of previous cuts and ongoing fiscal stimulus on the economy.

Tesla reported a steep 37% drop in net profit in the three months to September despite record quarterly revenue of $28 billion, up 12% from the same time last year. Sales were driven by increased US purchases ahead of the expiration of an EV tax credit.

General Motors raised its 2025 financial guidance after beating earnings expectations for the third quarter. Adjusted earnings excluding special items were $3.38 billion, versus $2.72 billion expected.

Vietnamese Prime Minister Pham Minh Chinh said the government would aim for record GDP growth of at least 10% in 2026. Growth this year was estimated at 8%, he told parliament.

Thailand’s cabinet approved a set of measures aimed at stimulating domestic tourism and spending during the high season from late 2025 to early 2026. They include personal income tax deductions, corporate tax incentives, a hotel renovation tax deduction, extension of the entertainment business tax reduction, and accelerated government seminar budget disbursement.

The Ministry of Finance will consider opening a new round of registration for the Khon La Khrueng Plus co-payment scheme, after all 20 million available slots were filled on the first day of registration.

The Bank of Thailand expects the co-payment scheme to help drive GDP to expand by 0.5% quarter-on-quarter in the fourth quarter, recovering from a 0.5% contraction in the previous quarter.

Thailand’s foreign tourist arrivals from Jan 1 to Oct 19 fell 7.45% from a year earlier, to 25.65 million, the Ministry of Tourism and Sports said. In the week to Oct 19, arrivals rose 6.6% from the week before to 556,000 despite a 5.3% fall in Chinese arrivals, which are down 29% for the year.

Car production rose 4.77% in September from a year earlier to 128,104 units, the Federation of Thai Industries said. Exports rose 7.2% to 86,056 units. For the first nine months of 2025, exports were down 10.4% to 689,031 units and production was down 4.6% to 1,075,801 units.

The Board of Investment (BoI) said Thai digital investment had risen from 25 billion baht in the first half of 2024 to 218 billion in the second half and to 522 billion in the first six months of this year, supporting data centre capacity growth from 300 megawatts to 3,000 MW within five years.

The National Broadcasting and Telecommunications Commission will propose an Internet Half-Half programme for state welfare cardholders next week. Participants are expected to receive internet service at 160 baht a month.

The Ministry of Energy confirmed it will end price subsidies for gasohol and biodiesel blends on Sept 24, 2026, after two extensions.

The Thai Retailers Association said its retail confidence index for the three months to Dec 31 reached a 12-month high of 63.8, reflecting optimism about government stimulus, particularly Half-Half Plus, which could increase sales by at least 10%.

COMING UP: On Monday, the US releases monthly durable goods orders, and on Tuesday the Conference Board announces the consumer confidence index. On Wednesday, the Fed and the central banks of Canada and Japan all announce rate decisions. On Thursday, Germany, the euro zone and the US will all release third-quarter GDP, the European Central Bank holds a rate meeting and China releases its manufacturing PMI. On Friday, the euro zone reports inflation and the US announces core personal consumption expenditure.

STOCKS TO WATCH: Asia Plus Securities says the SET is showing signs of recovery after falling 7% since Jan 1, underperforming regional peers. Analysts say easing external pressures and domestic stimulus could build more momentum.

Based on 60-day volatility and weekly returns, sectors showing lower volatility and growing investor interest are banking, insurance, ICT and energy. The brokerage recommends accumulating stocks in these sectors, favouring KTB, KBANK, BLA, TLI, ADVANC, PTT, PTTEP, TOP and CPALL.

Bualuang Securities recommends “forerunner” stocks: companies whose profits are expected to grow and recover strongly in the third and fourth quarters, with no significant earnings downgrades over the past three months and clear positive catalysts. These include ITC, COM7, CPALL, WHAUP, GULF and ADVANC.

Also recommended are “pace chasers”: firms projected to see a strong rebound in the final quarter through next year driven by sales recovery despite potentially weak Q3 earnings. Those include CENTEL, AOT, CPN, PTTGC and SCC. “Pace keepers”, expected to offer high dividend yields early next year, include KTB, with a projected yield of 6.5%.

TECHNICAL VIEW: InnovestX Securities sees support at 1,270 points and resistance at 1,335. Daol Securities sees support at 1,289 and resistance at 1,324.

Source – Bangkok News