European defense stocks slide amid Ukraine peace talks; Leonardo falls nearly 4%

A Rheinmetall MAN Military Vehicle on Nov. 20, 2024, in Donetsk Oblast, Ukraine.

Yan Dobronosov | Global Images Ukraine | Getty Images

LONDON — European stocks were mixed on Monday, with mining sector gains offseting defense stock losses.

The pan-European Stoxx 600 index stood little changed during early afternoon deals, having hit an intraday record high of 589.61 points earlier in the session.

The U.K.’s FTSE index and France’s CAC 40 both traded marginally higher, while Germany’s DAX and Italy’s FTSE MIB were slightly lower.

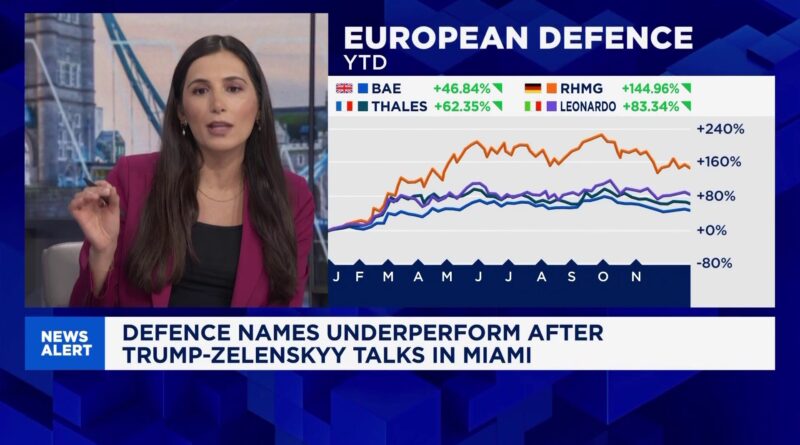

European defense stocks dipped following weekend peace talks between U.S. President Donald Trump and Ukrainian counterpart Volodymyr Zelenskyy.

Shares of Leonardo fell 3.6% and Rheinmetall dropped 2.5%, while Renk, Kongsberg and Saab fell more than 1.5%, respectively. The Stoxx Europe aerospace and defense index was 1.6% lower. Mining stocks were trading higher, with the sector last seen up 1.2%.

While peace talks could lead to a setback for defense stocks, Sydbank analyst Jacob Pedersen said “it will quickly be apparent that the investments needed in defense in Europe will continue and they will accelerate massively over the next years.”

“Definitely a positive potential for European equities if we get some kind of peace,” Pedersen told CNBC’s “Squawk Box Europe” on Monday.

Looking at individual stocks, French biotech Abivax was up 3.9% in afternoon deals, among the top performers in Europe’s blue-chip index. The clinical stage drugmaker has been the subject of takeover rumours and optimism about the prospects for its lead asset – a treatment for ulcerative colitis.

London-listed miner Fresnillo climbed 1.5%. Shares have rallied more than 400% this year, mirroring big gains in precious metals.

Silver climbed above $80 an ounce for the first time early Monday before pulling back. The precious metal was last seen trading at $74.20 an ounce. Gold dropped 1.6% to last trade at $4,458 an ounce, and copper fell 2.3% to $5.71 an ounce.

Trading volumes could be lighter this week, given the ongoing Christmas holidays and with regional markets set to close Thursday for New Year’s Day.

The prospect of a peace deal for Ukraine before the year’s out is fading after Trump and Zelenskyy said on Sunday that progress had been made during talks to end the war but that “one or two very thorny issues” remained.

Oil prices pop

Oil prices rose as investors weighed the prospects of a deal to end the war in Ukraine.

U.S. crude oil rose 2.6% to $58.23 a barrel, while global benchmark Brent gained 2.4% to $62.12. Both benchmarks fell about 2% on Friday.

Trump had been targeting a peace deal before Christmas, but Ukraine and Russia remain far apart when it comes to territorial concessions demanded by Russia and security guarantees coveted by Ukraine.

Speaking to reporters following talks in Florida on Sunday, Zelenskyy said they had come to an agreement on around “90%” of a 20-point peace plan and that the leaders had fully agreed on security guarantees for Ukraine. Trump was slightly less bullish on that front, saying an agreement was “close to 95%” done.

There are no major European earnings or data releases on Monday.

U.S. futures were modestly lower in premarket trading with the S&P 500 falling 0.2% and the Nasdaq 100 0.4% lower at 5:30 a.m Eastern time.

Source – Middle east monitor